Retail media is rapidly reshaping the advertising landscape. As more shopping shifts online and retailers invest in digital transformation, brands are seizing the opportunity to reach consumers where they’re actively browsing and buying. But this shift isn’t just about placing ads on product pages – it’s about leveraging a rich ecosystem of first-party data and precision targeting to drive measurable results.

So what exactly is retail media?

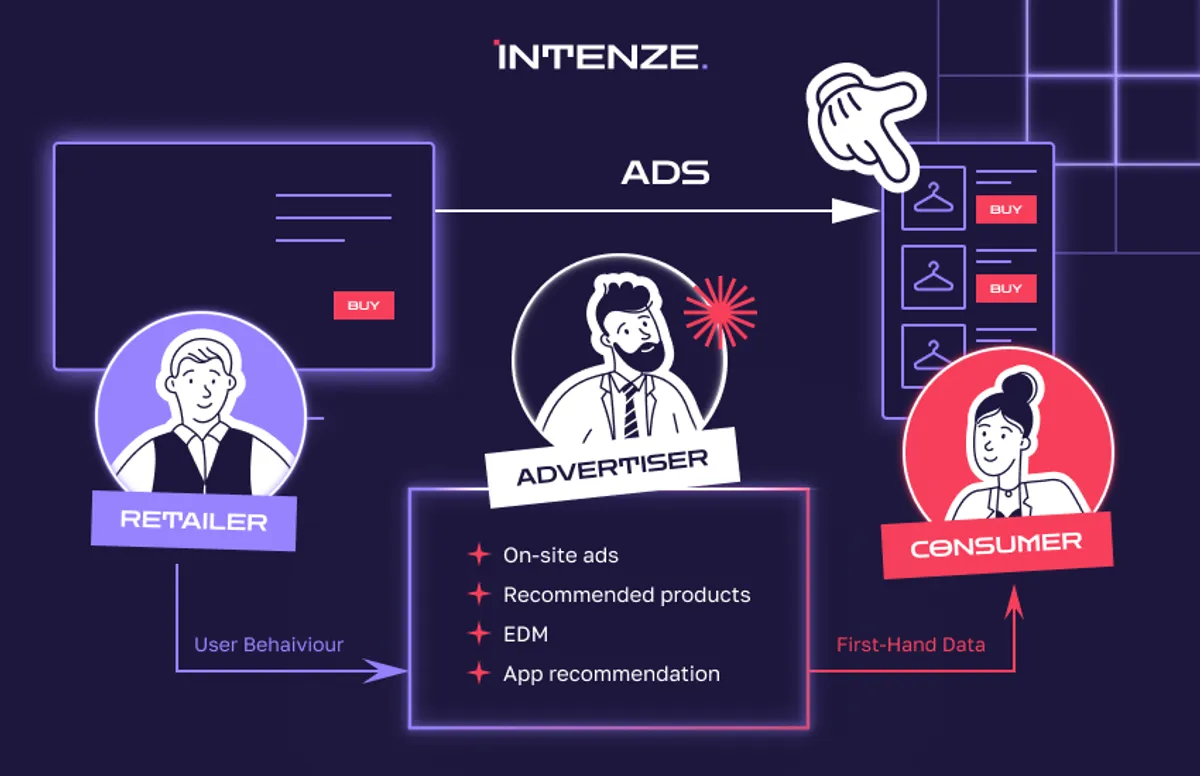

Retail media refers to advertising that takes place within a retailer’s own ecosystem – this includes product ads on e-commerce sites, banner placements in mobile apps, or even digital screens in brick-and-mortar stores. To facilitate this, retailers have built Retail Media Networks (RMNs) – platforms that allow brands to purchase ad space using insights drawn from shopper behavior and transactional data.

With third-party cookies on the decline and privacy-first marketing on the rise, RMNs have become a strategic priority for both retailers and advertisers. These networks offer a rare combination: access to high-intent audiences, a closed-loop measurement environment, and a powerful new revenue stream for retailers themselves.

And this is where programmatic comes in. It’s the engine behind the scenes – automating ad buying, using real-time data to fine-tune targeting, and helping brands deliver personalized messages both on and off the retailer’s site. In short, programmatic makes retail media smarter, faster, and more impactful.

The Programmatic Opportunity

Programmatic technology is the engine powering retail media’s scalability and efficiency. Through integrations with major DSPs like The Trade Desk, Google DV360, and Criteo, RMNs enable brands to buy inventory programmatically and activate campaigns in real time.

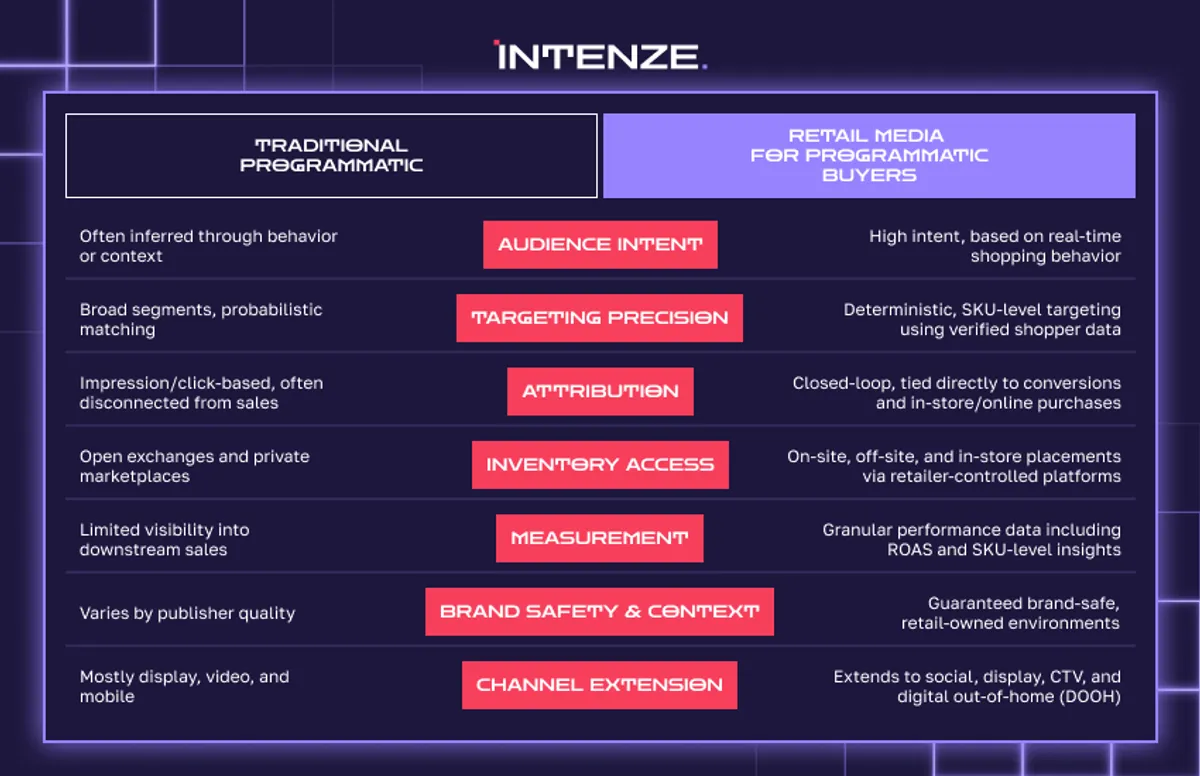

Retail media is no longer confined to on-site placements - it now spans off-site channels including programmatic display, social platforms, CTV, and even digital out-of-home (DOOH). What makes this ecosystem particularly powerful is data enrichment: retailers feed first-party shopper data into programmatic systems, allowing advertisers to personalize messaging, optimize performance, and reach high-intent shoppers across every touchpoint.

What Makes Retail Media Different for Programmatic Buyers?

For programmatic buyers, retail media brings a unique set of advantages that traditional channels can’t match. First and foremost, it’s all about intent – ads are shown to shoppers who are actively browsing, comparing, or about to buy, which leads to stronger performance and higher return on ad spend. Then there’s the data. Retailers have incredibly rich first-party data tied directly to real purchase behavior, not just clicks or impressions. When programmatic platforms tap into this data, targeting becomes smarter and more relevant. Another big plus? Retail media offers closed-loop attribution – buyers can actually see how their ads drive sales, both online and in-store. And because many RMNs now support off-site programmatic campaigns, advertisers can extend that same precision targeting across channels like display, social, and CTV. It’s a win-win: the efficiency and automation of programmatic meets the high-quality audience and measurable results of retail media.

Retail media may use the same pipes as programmatic advertising, but the value proposition is very different. While traditional programmatic focuses on scale, automation, and audience reach, retail media brings in precision, intent, and closed-loop measurement. The table below breaks down the key differences – and why more programmatic buyers are shifting budget toward Retail Media Networks (RMNs):

Retailers as Walled Gardens

Despite the promise of retail media, access isn’t always straightforward. Most large retailers operate as walled gardens, keeping tight control over their inventory and data. Unlike open exchanges, RMN inventory is typically available only through direct deals or curated private marketplaces.

To balance data security with advertiser needs, many RMNs now offer clean rooms – secure environments where brands and retailers can match data without compromising privacy. Still, a tension remains: retailers want to protect their data and ad experience, while advertisers seek broader access and efficiency. Navigating this dynamic is one of the key challenges in scaling programmatic retail media.

CTV, Social, and Retail Media Convergence

How RMNs extend targeting to CTV and social via programmatic

Retail media isn’t confined to a retailer’s website. Through programmatic integrations, RMNs are extending their data into CTV, social platforms, and off-site display, creating seamless brand experiences across channels.

For example, a shopper browsing skincare products on a retailer’s site may later see a tailored video ad on Hulu or a product carousel on Instagram – powered by the same intent data. This convergence allows brands to maintain message continuity and relevance while moving fluidly between awareness, consideration, and conversion.

Omnichannel impact and evolving media planning approaches

Retail media is transforming omnichannel planning. Instead of managing fragmented campaigns across digital, physical, and streaming environments, brands can now execute cohesive, full-funnel strategies using unified retail data.

Programmatic access allows advertisers to align messaging across every touchpoint – from a sponsored product on a retailer’s homepage to a digital billboard near a store – all tied to the same customer profile. Media planners are shifting away from demographic-based buying toward behavior-led targeting, using real purchase signals to inform creative and channel selection.

Measurement, Attribution & First-Party Data Gold

What sets retail media apart is its ability to tie media exposure directly to sales. Retailers have access to first-party datathat includes real transactions, loyalty activity, and in-store behavior – data that’s becoming increasingly rare in a privacy-first landscape.

With programmatic integration, advertisers can achieve closed-loop attribution and measure the true impact of each campaign. They can see not just who clicked, but who bought – online or offline – and use that feedback to refine targeting and creative in real time. In today’s data-fragmented environment, this level of transparency and accuracy is an invaluable asset.

Conclusion

Retail media is no longer just a retail trend – it’s becoming a cornerstone of modern programmatic advertising. By combining rich first-party data, high-intent audiences, and omnichannel reach, RMNs offer a powerful way for brands to drive performance and build long-term customer relationships. As programmatic technology continues to evolve, retail media will only grow more sophisticated – and more central to every advertiser’s strategy.